Tax season is here! Today, I want to clear up a big tax mistake that costs you hundreds—if not thousands—of dollars every year.

The difference between tax deductions and tax credits.

Most people think they work the same way, but they don’t. And if you don’t understand the difference, you’re not saving as much as you could.

The Problem: The Tax Code Is a Mess

The tax code is notoriously complex. There are endless rules, exceptions, and loopholes that make it hard to know what you actually qualify for.

And because of that, a lot of business owners miss out on tax benefits they should be using.

Why Most People Focus on the Wrong Tax Breaks

A common mistake? Focusing only on deductions while overlooking credits.

For example, some entrepreneurs max out every deduction possible but miss tax credits that could have saved them even more.

That’s why it’s important to understand the difference between tax credits and tax deductions and how they can help you.

Let’s break them both down.

What Are Tax Deductions?

Tax deductions are expenses or losses you (or your business) incurred over the year.

Businesses can deduct things like:

- ✅ Office expenses

- ✅ Employee wages

- ✅ Business travel

- ✅ Marketing costs

Individuals can deduct things like:

- ✅ Mortgage interest

- ✅ Charitable contributions

- ✅ Medical and dental expenses

How Do Tax Deductions Help?

Deductions reduce your taxable income, which means you get taxed on a smaller amount.

Example:

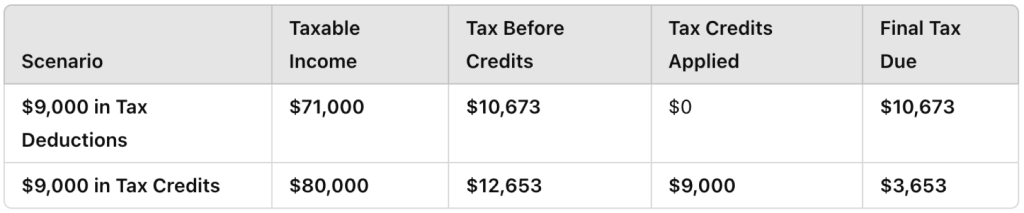

Say you made $80,000 this year and have $9,000 in tax deductions. Normally, you would owe $12,653 in federal taxes on the $80,000 you made in 2024.

But when you apply the $9,000 in tax deductions, your taxable income drops from $80,000 to $71,000. Assuming you don’t have any more credits or tax deductions…

In the tax year of 2024, you will owe $10,673 in federal taxes (not including FICA or state tax). Your tax bill is lower, but tax deductions are not the biggest money-saver you could use.

What Are Tax Credits?

Tax credits directly lower your tax bill—dollar for dollar. The government offers these credits as incentives to encourage certain actions, such as:

- • Pursuing higher education

- • Having children

- • Donating to charity

To qualify, you usually need to meet specific requirements.

But when you do, your tax savings could be huge.

Why Tax Credits Save You More Than Deductions

Let’s go back to that $80,000 example:

Say you made $80,000 this year, and your tax bill was $12,653. But instead of taking a deduction, you claim a $9,000 tax credit.

That means instead of owing $12,653, you now only owe $3,653.

That’s a massive difference!

Here’s a chart recapping both of our examples:

How to Maximize BOTH for the Biggest Tax Savings

The smartest move? Claim every deduction AND credit you qualify for.

You can save a lot of money with tax credits. However, you can save even more money when claiming tax credits and deductions together.

✔️ Deductions lower how much of your income gets taxed.

✔️ Credits lower what you actually owe.

If you qualify for refundable tax credits, you could even get a refund bigger than what you paid in.

Don’t Leave Money on the Table

The IRS isn’t going to tell you if you missed out on tax savings. That’s why it’s up to you to know what you qualify for and claim every deduction and credit possible.

If you want to make sure you’re not overpaying (and get strategies to keep even more money in your pocket), click below to book a call with one of our tax experts.

FAQ

Q: What’s the difference between a tax deduction and a tax credit?

A: A tax deduction reduces your taxable income, which means you pay taxes on a smaller amount. A tax credit, on the other hand, directly lowers the amount of taxes you owe—dollar for dollar.

Q: Why is it important to understand the difference?

A: Many people focus only on deductions and overlook credits, which can sometimes save them even more. Understanding both allows you to maximize your tax savings.

Q: What are some common tax deductions for businesses?

A: Businesses can deduct expenses such as:

- Office expenses

- Employee wages

- Business travel

- Marketing costs

Q: What are some common tax deductions for individuals?

A: Individuals can deduct expenses such as:

- Mortgage interest

- Charitable contributions

- Medical and dental expenses

Q: How do tax deductions help me save money?

A: Tax deductions lower your taxable income. For example, if you earn $80,000 and claim $9,000 in deductions, you’ll only be taxed on $71,000 instead of the full $80,000—resulting in a lower tax bill.

Q: What are tax credits, and why are they more valuable than deductions?

A: Tax credits directly reduce the amount you owe in taxes. If your tax bill is $12,653 and you claim a $9,000 credit, your new tax bill drops to $3,653. Unlike deductions, which only lower taxable income, credits reduce your actual tax liability dollar for dollar.

Q: What are some common tax credits?

A: Some popular tax credits include:

- Education credits for tuition and fees

- Child tax credits for having dependents

- Energy-efficient home improvement credits

- Earned Income Tax Credit (EITC) for low to moderate-income workers

Q: Can I claim both tax deductions and tax credits?

A: Yes! The best strategy is to claim every deduction and credit you qualify for to maximize your savings.

Q: What happens if I don’t claim all my eligible deductions and credits?

A: You could end up overpaying your taxes, sometimes by thousands of dollars. The IRS won’t remind you if you miss out on tax breaks, so it’s up to you to ensure you’re taking advantage of every deduction and credit available to you.

Q: How can I make sure I don’t miss out on tax savings?

A: Work with a tax professional or educate yourself on tax laws. Make sure you track eligible expenses, research available credits, and file your taxes correctly to claim every benefit you qualify for.

P.S. If you want to read more content, click here to read another article.